Long Term Market Price

You are the pricing manager of a car dealership. Through your vast experience of being a pricing manager, you know that there are 3 different kinds of customers with different willingness to pay for the following:

Customer 4 Wheel Drive Leather Seats

A $5,000 $2,000

B $3,000 $1,500

C $500 $3,000

For simplicity, assume that the firm’s costs are $0.

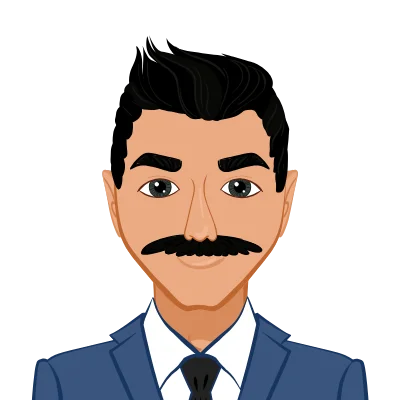

1. Suppose the pricing manager immediately knows the willingness to pay each customer as soon as the customer walks into the door of the dealership. What is the optimal pricing strategy? How many profits will be made and what is the consumer surplus? Show your calculations.

Solution:

The optimal strategy is to price 4 Wheel Drive at $3,000 and Leather Seats at $1,500.

There will be 10,500 profits made (6,000 + 4,500) and the customer surplus is 4,000 (2,000 + 2,000).

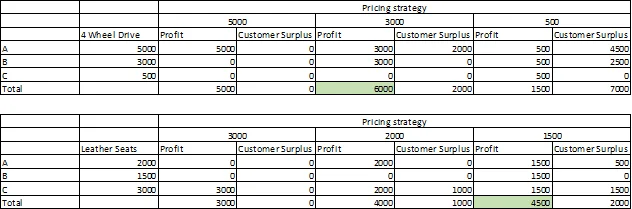

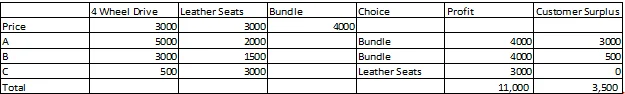

2. Suppose the manager does not know each customer’s willingness to pay. The manager decides to sell 4 Wheel Drive by itself for $3,000 each, leather seats by itself for $3,000 each but offers a special package/bundle (4 Wheel Drive AND leather seats) for $4,000.

Now, customers can either buy the special package/bundle OR each of the options (4 Wheel Drive or Leather Seats) individually.

a. Which customers will buy the individual options for $3,000 each and which customers will buy the special package/bundle for $4,000? Remember that each customer buys either the individual option(s) or the bundle or nothing - each customer will not buy both the bundle and either of the individual options. Explain why.

Customers A and B will buy a bundle, and customer C will go for the Leather Seats. If a customer was willing to pay for the 2 items individually at least the same combined price as the price of the bundle, then they will go for the bundle since it maximizes their surplus.

b. Given your answer above, how much profits will be made, and what is consumer surplus? Show your calculations.

Solution:

20. The profits of the four major networks (CBS, NBC, ABC, and Fox) depend significantly on the ratings of its prime-time shows. The higher the ratings, the higher the price the network can charge for advertising and the higher the profits of the network. To keep things simple, we will focus on two networks, CBS and NBC, and two of the prime time spots, 8-9 PM and 9-10 PM.

Each network needs to decide which time slot to place its hit show, 8-9 PM or 9-10 PM. The other time slot will be filled by a run-of-the-mill show.

The following payoff matrix shows the total number of viewers (in millions) if each network places its hit show in each of the time slots:

CBS

8-9 PM time slot 9-10 PM time slot

NBC 8-9PM time slot 12,14 14,12

9-10PM time slot 10,12 11,10

1. If you are the program manager for CBS, what time slot would you place your hit TV show (assuming that your goal is to maximize the number of viewers)? Please explain why.

Solution:

I would choose the 8-9 PM time slot as it is a strictly dominant strategy. Irrespective of which slot NBC chooses for its hit show, CBS will maximize its number of viewers by choosing 8-9 PM time slot (14>12 if NBC chooses8-9 PM time slot, and 12>10 if NBC chooses 9-10 PM time slot).

2. If you are the program manager for NBC, what time slot would you place your hit TV show (assuming that your goal is to maximize the number of viewers)? Please explain why.

Solution:

I would choose the 8-9 PM time slot as it is a strictly dominant strategy. Irrespective of which slot the CBS chooses for its hit show, NBC will maximize its number of viewers by choosing 8-9 PM time slot (12>10 if CBS chooses 8-9 PM time slot, and 14>11 if CBS chooses 9-10 PM time slot).

3. What is the outcome of the game? Explain

Solution:

Both will go for the respective dominant strategy and choose the 8-9 PM time slot.

4. Using the payoff matrix above, is there an incentive for NBC and CBS to collude and agree to put their hit shows in different time slots than your answers to 1) and 2)? Explain your answer.

Solution:

NBC would have liked CBS to choose a 9-10 PM time slot for their show, but CBS loses in this scenario. Hence, CBS has nothing to gain from the collusion, while NBC would have preferred to collude.

5. Now suppose the payoff matrix for NBC in the 9-10 PM time slot was changed from 11 to 15, as shown below:

6. CBS

8-9 PM time slot 9-10 PM time slot

NBC 8-9PM time slot 12,14 14,12

9-10PM time slot 10,12 15,10

Would your answer to 1), 2), 3) and 4) above change? Please explain your answer.

Answers to 1), 2), 3), 4) would not change.

1. At the "Salon Deco" Hair Salon, women are charged different prices for haircuts (with shampoo and blow-dry) based on whether they have long hair or short hair. Is this an example of price discrimination? Explain why or why not.

Solution:

No. The amount of effort (labor), shampoo, and time to dry (resources) differ based on hair length, so essentially it’s a different product. In this case, it’s not pricing discrimination.

23. "Salon Deco" offers 10% off all hair service to first-time customers.

Under what circumstances will this pricing practice increase revenues and profits versus having just 1 price for all customers? Explain why revenues and profits will increase with this pricing strategy versus having just 1 price for all customers.

Solution:

This practice will increase revenues and profits if "Salon Deco" needs to attract new customers (e.g., it is lacking customers, so there is idle time for hairdressers). Incrementally, new customers will lead to more profits, otherwise, there would have been zero profit during the idle time.

54. The wild rice market is highly competitive.

Your firm, The Wild Rice Bowl, produces wild rice.

Suppose the demand for wild rice increases.

(1) Discuss what will happen to the market price and quantity sold of wild rice in the short run and in the long run. Explain why.

Solution:

In the short run, the price will go up and the quantity sold might increase slightly (or even stay the same depending on inventory strategies).

In the long run, when the producing capacities adjust, the price might drop almost to the previous level, while the quantity of price sold will increase.

(2) What will happen to your firm's economic profit in the short run and in the long run? Why?

Solution:

Economic profit will increase in the short run and might stay the same or increase in the long run (depending on the level of average costs of my firm). In a highly competitive industry, inefficient firms will be driven out from the market, while the economic profit is zero in a perfectly competitive market in equilibrium.

Now suppose that demand for wild rice increases a second time but that the government now forbids entry by new wild rice producers

(3) Discuss what will happen to the market price and quantity sold of wild rice in the short run and in the long run.

Solution:

Both in the short run and long run, the price will go up, while the quantity remains the same (due to lack of spare producing capacity and new producers).

(4) What will happen to your firm's economic profit in the long run? Why?

Solution:

Economic profit will go up. At the new level of demand, the price will remain higher, thus, increasing the economic profit. The lack of new producers means no new competitors.

(5) Is the firm's long-run economic profit higher or lower when entry is forbidden or when entry is allowed? Why?

Solution:

the firm's long-run economic profit is higher when entry is forbidden because the prices go up with the increase in demand, while the supply remains relatively stable.

(6) What is the lesson illustrated in your answer to part (5)?

Solution:

Firms naturally strive to reduce competition and restrict entry to the market by new producers.

Related Samples

Discover our extensive collection of sample materials tailored specifically to microeconomics, offering a wide range of examples that highlight key economic principles, theories, and applications. Delve into practical case studies elucidating concepts such as supply and demand analysis, consumer behavior modeling, market equilibrium, and more, providing valuable insights into the intricate dynamics of microeconomic phenomena.

Microeconomics

Microeconomics