Markets Pricing Strategy Problem

Q 1. French's Mustard Co. sells mustard in 2 markets: the at-home market (supermarkets) and the away-from-home market (restaurants, arenas, schools, etc.)

Suppose French's charges the away-from-home market a lower price than the at-home market.

(1) Discuss the circumstances where it makes sense for French's to charge a lower price in the away-from-home market. Explain why and how this pricing strategy benefits French's versus charging just one price in both markets.

Charging different prices for the same product is called price discrimination. It makes sense for French’s to charge a lower price in the away-from-home market if the target consumer base is more sensitive to price. Charging a lower price allows French’s to gain more customers at that market and maximize profits there through higher sales volumes.

(2) French's puts "not for resale" labels on the bottles of mustard it sells to the away-from-home market. Explain why the French do this and how this benefits French's.

Usually "not for resale" labels are put on samples or give-away items to prevent scammers charging customers for the product, which was not intended to be sold. In this case, French’s is trying to avoid a situation where resellers would buy their mustard at the away-from-home market and sell it in the at-home market with a margin, thus, competing with French’s own mustard sold there.

Q 2. Charter Cable TV did some data analysis of its customers and discovered that some customers watch certain types of programs. There are the "True Crime" buffs who love to watch shows on their True Crime channels. There are the "History" nuts who like to watch shows on their History channels.

Charter Cable TV surveyed these customers and found the following average willingness to pay of True Crime Buffs and History Nuts for each of the channels.

Now, it is trying to decide whether to sell a bundle of both the True Crime channel and the History Channel.

Willingness to Pay

Number of Customers True Crime Channel History Channel

True Crime Buffs 10,000 $20 $4

History Nuts 2,000 $3 $10

Assuming that the incremental cost of serving 1 more customer for both channels is zero:

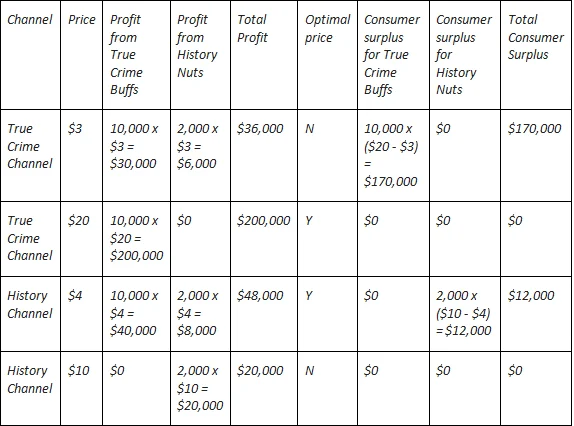

1. Suppose Charter Cable TV decides to have 1 price for the True Crime channel and another price for the History Channel. What are the optimal prices for each channel and what are your profits? What is the consumer surplus? Show your calculations.

We can calculate profits for Charter Cable TV for different pricing strategies:

The optimal prices are $20 for True Crime Channel and $4 for History Channel. Total profit in this case is $200,000 + $48,000 = $248,000, while consumer surplus is $12,000.

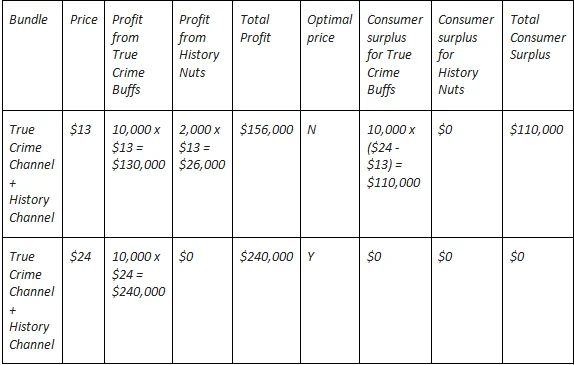

2. Suppose Charter Cable TV now decides to bundle the 2 channels and will charge only 1 price for both channels. What is the optimal price and what are your profits? What is the consumer surplus? Show your calculations.

The optimal price for the bundle is $24. Total profit, in this case, is $240,000, while consumer surplus is $0.

3. Should Charter Cable TV offer the bundle? Why or why not?

Charter Cable TV should not offer the bundle. It will be less optimal for the firm as well as for the customers. Leaving separate pricing for the two channels will allow the company to maximize profits.

Q 3. Two food trucks play a simultaneous pricing game. The following shows the profits of each food truck depending upon which price they choose:

Food Truck B

Low Price High Price

Food Truck A Low Price $400, $600 $100, $700

High Price $600, $300 $150, $400

1. What is the optimal strategy for Food Truck A? Is it a dominant strategy? Explain why or why not.

Food Truck B

Low Price High Price

Food Truck A Low Price $400 $100

High Price $600 $150

Given there is no cooperation, the optimal strategy for Food Truck A is High Price. It is a dominant strategy because it yields higher profits than Low Price regardless of the decisions of Food Truck B.

2. What is the optimal strategy for Food Truck B? Is it a dominant strategy? Explain why or why not?

Food Truck B

Low Price High Price

Food Truck A Low Price $600 $700

High Price $300 $400

Given there is no cooperation, the optimal strategy for Food Truck B is High Price. It is a dominant strategy because it yields higher profits than Low Price regardless of the decisions of Food Truck A.

3. Is the Pricing decision facing the 2 food trucks a prisoner’s dilemma situation? Why or why not?

Yes, this is a prisoner’s dilemma. If the two food trucks cooperate and both choose Low Prices, they will be better off. However, without implicit cooperation or means to force the other Food Truck to choose certain strategies, High Price yields better results for both. Thus, the rational choice will be High Prices for both Food Trucks.

4. What is the outcome of the game if the food trucks do not cooperate (or cannot come to an agreement) in making the decision to choose their prices? Why?

Both will choose High Price because it is strictly a dominant strategy for both.

5. What is the outcome of the game if the firms do cooperate (can agree upon prices) in making the decision to choose their prices? Why?

Both will choose Low Price because it maximizes the returns for both Food Trucks compared to other scenarios.

Q 4. You own Bob’s Catering which has just received the one and only license to serve food at the Bucks County Flea Market, a huge marketplace with thousands of sellers of all sorts of merchandise. The license lasts for 3 years. After 3 years, other caterers and food vendors are allowed to enter the flea market.

1. What would you predict about the level of profitability of Bob’s Catering during the first 3 years? Why?

The profitability of Bob’s Catering will be high because it will be a monopoly, thus, will be free to decide the price and production levels to optimize its profits.

After 3 years, other firms begin serving food at the Bucks County Flea Market:

2. After these new firms begin serving food at Bucks County Flea Market, what would you expect to happen to the prices of Bob’s Catering food at Bucks County Flea Market? What would you expect to happen to Bob’s Catering profits? Why?

Bob’s Catering food will lose its monopoly and will lose its ability to set the prices. The prices of Bob’s Catering food at Bucks County Flea Market will have to decrease, otherwise, it will lose all customers to the new competitors. The profits will decrease substantially due to competition.

3. After 3 years, assume that any firm that wants to serve food is free to do so at Bucks County Flea Market. In the long run, what would you expect to happen to the profitability of all firms that serve food at Bucks County Flea Market? Why?

The profitability of all firms will reach a certain equilibrium level. Firms that cannot compete on price and quality will go out of business leaving only companies who may sustain their operations at this profitability level in the long run. It makes sense to remain in the business in the long run only if the firm is able to achieve acceptable levels of returns.

Related Samples

Discover our extensive selection of sample materials tailored for students of financial economics. These resources offer a rich variety of real-world examples elucidating fundamental financial principles, market assessments, analyses of consumer behavior, and strategic decision-making methodologies. Delve into these samples to gain valuable insights into the intricate dynamics of financial economic theory and its pragmatic applications.

Financial Economics

Financial Economics