Claim Your Discount Today!

Unlock a fantastic deal at www.economicshomeworkhelper.com! Enjoy an exclusive 10% discount on all Economics homework this Spring Semester with the code EHHrSPRING10. Our expert team is ready to support you, ensuring top-quality assistance at the best price. Don’t miss this limited-time opportunity to excel in your studies while saving money. Use the code at checkout and secure expert help for your Economics homework today!

We Accept

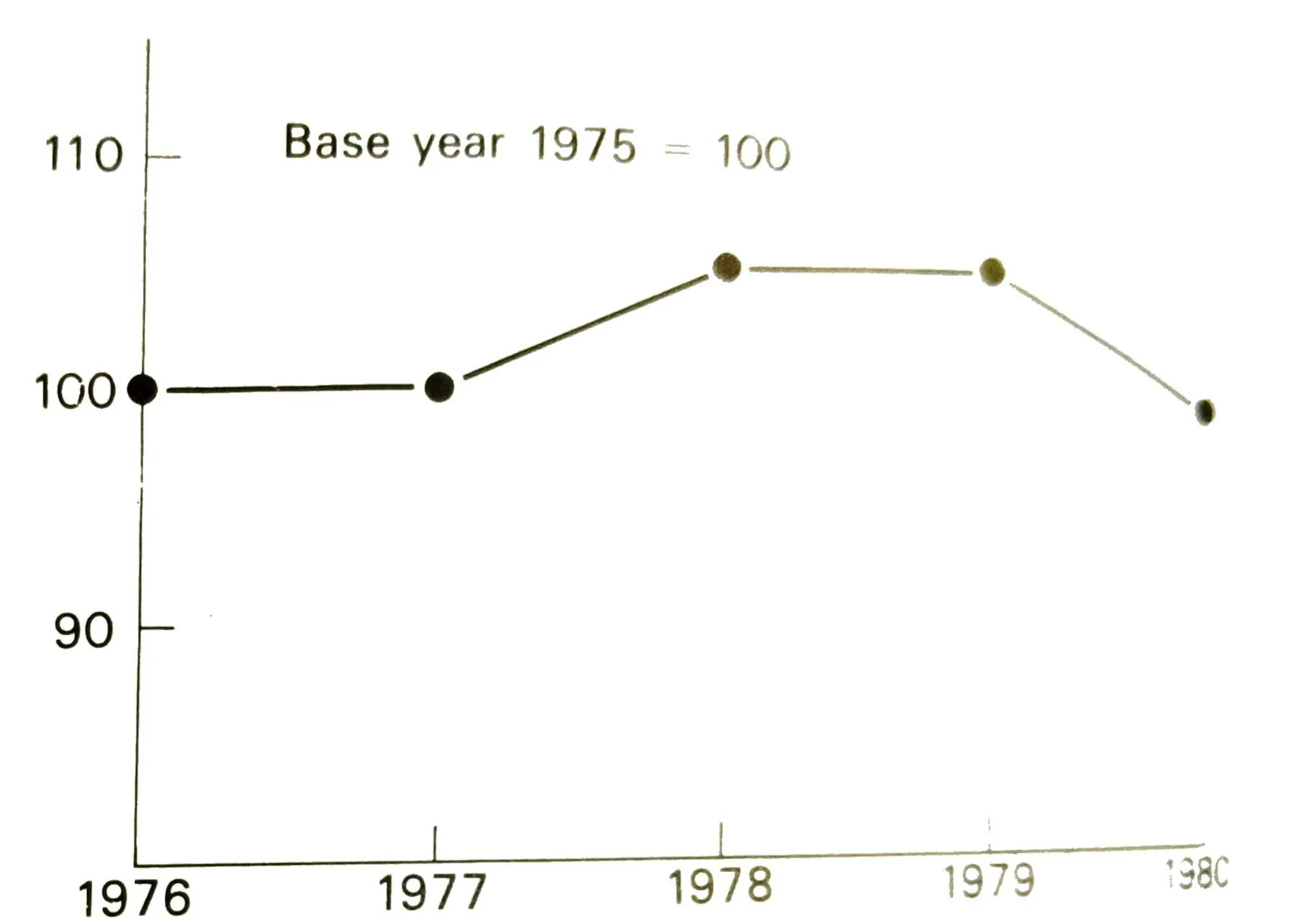

Understanding trade and its terms is not an easy task. Several tools might help learn more about the topic such as Case Studies, Assignments, Projects, and so on. Ask for economics homework help if needed. Let us try to understand the terms of trade using this blog. The terms of trade express a relationship between the prices of a country's imports and the prices of its exports and are calculated by dividing export prices by import prices and multiplying by 100. A certain year is taken as the base year. If the index is under 100, the terms of trade have moved against a country, but if the figure is over 100, then the terms of trade will have moved in that country's favor compared with the base year (see Fig. 9.7).

Figure 9.7 UK terms of trade 1976 to 1980. (Source: Department of Trade.)

In common parlance, we speak of the 'favorable' movement of the terms of trade if export prices have risen relative to import prices. Pedantically, it is not strictly accurate to think of favorable' or 'unfavorable' terms of trade in any absolute sense; it is f only the changes that mean anything in economics. The official terms of trade are calculated as b follows:

LetQi be a volume index for imports based on the year 1961

Qe be a volume index for exports based on the year 1961

Piis a price index for imports based on the year 1961

Pe be a price index for exports based on the year 1961

T be the net barter terms of trade

Gbe the gross barter terms of trade

I will be the income terms of trade.

The index of the UK terms of trade, which is calculated by the Department of Trade, is:

T= Pe/pi x 100

This is an index number form with 1961 as 100. Unfortunately, we do not have price indices, as such, for overseas trade, but the unit value indices are considered to be adequate substitutes. A rise in the terms of the trade index is normally regarded as a favorable movement for the UK because more imports can be bought for a given quantity of exports. However, it may imply that exports are becoming less competitive and this could lead to a decrease in the number of exports which would be an unfavorable movement. Although

T= Pe /Pi x 100

Pi is what is normally called the terms of trade it is sometimes called the net (barter) terms of trade and is distinguished from the gross (barter) terms of trade which are:

G = Qi / Qe × 100

again in index number form with 1961 as 100. Changes in G show variations in the real gain from trade realized. A rising value of G shows that a greater volume of imports is being purchased for a given volume of exports. This may be because important prices have fallen relative to export prices (which will be shown by T) or because of other factors in the balance of payments. The gross terms of trade are not shown in any official publications but can easily be derived from the published indices of the volume of trade that appear in the Annual Abstract and elsewhere.

There is another measure known as the income terms of trade (l) which is sometimes used. This is not compiled by the Department of Trade but can be calculated from the unit value and volume statistics that are published. It is I-Q, x 7, and is in index number form with the year 1961 as 100. 7 is sometimes called the capacity to import and shows changes in the volume of imports obtainable from the income earned from exports, compared with the base year. The terms of trade are, therefore, usually considered as a valued relationship (prices paid for commodities), but they may also be considered in terms of the volume of a country's imports and exports (the ratio at which the exchange of quantities of physical commodities takes place).

An individual country, unless it has a monopoly on a certain commodity, has little effect on the terms of trade, because it has to sell and buy in world markets where there are many buyers and sellers. There are many large firms producing motor cars in the USA, West Germany, France, Italy, and Japan, as well as in the UK. Similarly, there are many producers of wheat in Canada, the USA, Argentina, Australia, the

USSR, etc. One country may exert little influence by selling devices such as persuasive advertising or exhibitions abroad, but the impact is probably very small.

The ratio at which the exchange of goods between countries takes place depends upon the relative elasticities of demands for the goods being exchanged (exports-to-imports and vice versa). If consumers can be persuaded to use more saccharines and less sugar, then the demand for sugar will fall, and possibly the terms of trade would change for the countries involved. Two tonnes of sugar might be exchanged for one tonne of wheat, instead of one tonne of sugar; so the terms of trade for the wheat-producing country would improve. But on the whole, a country cannot significantly affect its terms of trade, because its production and/or consumption of a commodity is very small compared with the productive capacity of the other countries in the world.

A country can have adverse terms of trade and yet enjoy comparatively good times.

For example, the UK was relatively prosperous in 1913 although the terms of trade were unfavorable, this prosperity was largely the result of the interest received from past overseas investments and the earnings of invisible exports such as banking and insurance. In contrast, during the great slump of 1929-33 the terms of trade were favorable to the UK, but even allowing for nearly 3 million unemployed, there would have been even more suffering if the terms of trade at the time had been adverse. Producers of primary products did indeed suffer greatly; frequently, if the terms of trade move in favor of the manufacturing countries, they move against the primary producers and vice versa.

Since the Second World War, there has been great competition in primary products, while technological changes in manufacturing countries have produced artificial raw materials. The favorable terms of trade enjoyed by the industrialized countries for many years are likely to be reversed as the world population increases rapidly and the shortage of foodstuffs and raw materials becomes more acute. More countries are emerging from being primary producers to following the trend toward industrialization.

For many years the rich countries have been getting richer and the poor countries have been becoming poorer. People in manufacturing countries enjoy a very high standard of living. largely at the expense of the people producing primary products. This state of affairs has been to some extent brought about by the terms of trade, but as primary products become increasingly in short supply, they will command a higher price in world markets. Many of today's poorer countries should benefit, although a speedy improvement in their position is unlikely because of their lack of capital for development.

If a country finds that the products bought from other countries are increasingly expensive, it will probably attempt to produce the commodities itself, so that it may remove its dependence upon foreign suppliers. When countries with adverse balances of payments decide to produce commodities they have been in the habit of importing, the exporting countries may lose some of their profitable markets. Unfortunately for the 'have-nots', they usually lack the capital and technical 'know-how' to industrialize rapidly, although the International Bank for Reconstruction and Development is assisting by lending capital for productive purposes. The World Bank was established in 1944 when the Second World War was drawing to a close: many countries were partially in ruins and it was realized that a large amount of capital would be necessary for reconstruction work and the development of the poorer countries of the world. Modern wars have usually had deep-rooted economic causes and persistent poverty is a likely cause of friction and unrest. The World Bank was started by representatives of 44 nations who met at Bretton Woods, in the USA, to consider how 'A Brave New World' could be built, after the final peace treaty was signed. At Bretton Woods, it was decided that the main purpose of the World Bank should be to lend money to reconstruct war-torn countries:

- From its subscribed capital.

- By encouraging private investment in guarantees, so long as all loans were used for productive purposes.

Therefore, the loans ought not to be used to promote better educational or health services, although it could be contended, in the broadest sense, that an improvement in social services would advance economic growth. The World Bank lends money for economic projects that will bring an immediate tangible gain and that are more likely to allow the borrowing country to pay back the loan and the interest charged if any. In this category come electricity generating stations, industry (e.g., steel), agricultural machinery, and transport services.

In 1956, the International Finance Corporation (IFC) was set up as an affiliate of the World Bank and by 1975 had about 100 members. Its purpose is to encourage the growth of productive private enterprises in member countries and it only contributes funds if there is insufficient private capital available (see Fig. 9.8).

.webp)

Each member of the World Bank subscribes to the Bank's capital according to what is judged as a country's ability to pay. Like other banks, the World Bank is both a lender and a borrower. The Bank sells its bonds to investors and charges its borrowers over an average 15-year loan. The World Bank's comparatively high rate of interest is beyond the means of many poorer countries and could be one reason why the poorer have stayed poor. So, in 1960, the International Development Association (IDA) was established with the power to lend for 50 years without interest charges, in needy cases. The IDA is financed by capital contributions from over 100 member countries, and not (as is the case with the World Bank) by borrowing in the open market.

It is in the interests of world trade that there should not be countries with large surpluses while others struggle with large deficits. When some countries are in an over-favorable position for several years, and their exports command an extremely high price, then in the long run this situation will be bad for individual countries and the world as a whole. What is required is the balanced growth of international trade, so that all countries may benefit from the specialized productive abilities of the others. The World Bank has played an important part in some leveling of the terms of trade between developed and developing nations.

Comparative costs and free trade

International free trade is advantageous to all countries mainly because of what economists call the principle of comparative costs, which states that it is in the best interests of the people of the world if each country concentrates on producing the goods that it can produce more cheaply. This is merely an extension on a world scale of the division of labor, or specialization. Professor Lipsey, in An Introduction to Positive Economics (Weidenfeld and Nicolson). sums up the benefits:

As a positive hypothesis about the real world, the theory of comparative costs predicts that, in the real world, there will be gains from trade in the sense of increased world production, and that no country will lose from trade in the sense of having less to consume than it could have if it were self-sufficient.

The principle of comparative costs operates in several ways. A country may have an absolute advantage in the production of a commodity. Absolute advantage is usually considered in a simplified case of two countries: Country A can produce cotton and Country B cannot. Absolute cost advantages are related to inherent skill, available capital, and natural resources, e.g. North Sea oil. International trade will lower the price of such products in every country where they are sold.

A comparative cost advantage exists when two countries are capable of producing the same commodity, but one country can produce it far more cheaply than the other. The UK imports wheat, a product that she can produce herself. In fact, until the latter part of the eighteenth century, Britain was a wheat-exporting country. However. since that time, the flat, sunny, prairie provinces of Canada have been producing wheat on such a large scale that they have a comparative advantage over the UK in wheat production. In addition, Canadian wheat is 'hard', which is better for making flour for bread. British 'soft' wheat is more suitable for biscuit production. So it pays us to import the hard wheat that can be produced more economically on the American continent and concentrate on producing the things that we can manufacture more economically. The sale of our manufactured goods will bring us enough money to purchase more wheat than we could have grown, so the UK gains from importing a foodstuff that she can well grow herself. The UK's future depends, to a marked extent, on acquired and potential skills in such export businesses as computers, plastics, and man-made fibers, in which at present we possess a comparative advantage over many other countries.

Economists contend that there would be the most benefit to the world as a whole if international trade were conducted freely, on a multilateral basis, without the hindrances of customs duties or other trade restrictions. However, for a variety of reasons. the principle of comparative costs is not allowed to work freely in practice. China can produce rice cheaply under natural conditions, but for many years the USA preferred to grow rice under irrigated methods than trade with the People's Republic of China. Countries may lose their comparative advantage if they allow other countries to 'catch up. Once the UK had a comparative cost advantage in shipbuilding, fishing, cotton manufacture, coal, etc.. but other countries have adopted modern technological methods and overtaken us in these fields.

Probably the example of comparative costs that is most difficult to comprehend and appreciate is where it is assumed that there are only two countries and only two commodities, and where Country A can produce both commodities more cheaply than Country B and yet the real income and employment levels of both countries will be improved if they engage in trade with each other. Consider the case below, which proves that it is a comparative and not an absolute difference in costs that is the most important principle underlying the beneficial effects derived from international trading.

Although Country A can produce both cotton and wool more cheaply than Country B. it may still be advantageous for trade to take place between them. If it is assumed that 200 units of labor in Country A can produce either 200 units of cotton or 200 units of wool and that 200 units of labor in Country B can produce either 80 units of cotton or 160 units of wool, then if the labor force in each country is shared equally between the production of cotton and wool, the total production of the two countries will be as shown in Table 9.6(a).

Table 9.6a Comparative costs

| Units of cotton | Units of wool | Units of labor | |

| Country A | 100 | 100 | 200 |

| Country B | 40 | 80 | 200 |

| 140 | 180 | 400 |

As Country A is 2 times more efficient at producing cotton but only 1 time more efficient at producing wool, it would be possible to re-allocate the labor force so that total production would be as indicated in Table 9.6(b).

Table 9.6b Comparative costs

| Units of cotton | Units of wool | Units of labour | |

| Country A | 160 | 40 | 200 |

| Country B | 0 | 160 | 200 |

| 160 | 200 | 400 |

With this pattern of specialization, the total production of both cotton and wool has increased. This simplified example merely proves the point that if the principle thus demonstrated were adopted on a worldwide basis, then world production would increase. It is mainly because of the principle of comparative costs that economists favor free trade.

Free trade tends:

- To promote the diffusion of advanced technology.

- To provide consumers with a greater variety of goods.

- To increase employment possibilities throughout the world.

- To facilitate higher standards of living.

- To increase real output throughout the world.

These reasons help to explain the formation of the General Agreement on Tariffs and Trade (GATT) in 1948 as a result of a treaty signed at Havana. By 1980, about 100 countries were participating in GATT's work of trying to reduce existing trade restrictions. Countries who sign the GATT treaty accept four main principles:

- No member country should show trading discrimination against another.

- If the protection of home industries is felt to be essential, it should only be by customs duties, and not by fixed import quotas, which often work harshly against particular suppliers.

- Consultations should take place when tariff changes are contemplated so that traders should be warned and trading interests should not suffer unduly.

- Negotiations should be held with the intention of general reductions in tariffs and other trade barriers.

In recent years, a large part of the work of GATT has been devoted to the trade problems of developing countries, which now represent close to 66 percent of the total membership. The United Nations set up the Committee on Trade and Development (UNCTAD) to supervise practical work for the benefit of developing countries, such as export promotion and technical assistance.

The supporters of GATT appreciated from the outset that customs unions, or free trade areas, by which national economies are integrated, might be a way of contributing towards the main objective of a relaxation of restrictions on foreign trade. Several free-trade areas or associations have been established. Most of the contracting members are also members of GATT.

These free trade areas, common markets, or associations include:

The European Economic Community (EEC or Common Market) was established by the Rome Treaty.

- EFTA was established by the Stockholm Convention.

- Latin American Free Trade Association was established by the Montevideo Treaty.

- Central American Free Trade Association.

- Borneo Free Trade Area.

- New Zealand and Australia Free Trade Area.

- Central African Customs Union.

- Arab Common Market.

Although from the point of view of comparative costs, free trade is most desirable, arguments advanced against free trade (apart from the fact that the theory of the comparative cost assumes no transport costs and perfect competition) include:

- Customs duties provide a government with revenue.

- The excess of imports connected with a balance of payments deficit may be corrected by import duties, import quotas, or import deposits.

- Infant industries require protection until they can stand on their own feet.

- Countries already imposing tariffs have a bargaining weapon when trade concessions are under discussion.

- Workers expect to be protected against cheap labor abroad.

- Tariff walls may be erected to prevent foreign monopolistic concerns from' dumping' goods abroad at a low price so that they may maintain prices in the home market upon which they mainly depend.

- As other countries have trade protection measures, no country can afford to go it alone" and adopt free trade. When the UK did this in the late nineteenth century, it was subject to a trade depression as duty-free foreign goods flowed in whereas British exports were subject to tariffs.

- Military and political policies cut across free trade principles.

- Home industries may need subsidies to compete against foreign concerns that receive help from their governments.

In the eighties, the movement towards trade protection received fresh impetus as unemployment increased. In 1982, the US Congress considered banning all car imports. In the UK, the TGWU threatened to block imports of the General Motor Corsa car, while Mrs. Thatcher warned the Japanese to restrict their exports to Britain, particularly of machine tools and forklift trucks.

However, economists generally still believe in free trade, so long as free trade is fair trade. The answer to cheap Japanese imports is for the rest of the world to be more competitive and to concentrate on those things in which they have a comparative advantage. The UK has its peculiar opportunities to trade in aircraft, patented pharmaceuticals, oil and mining equipment, etc. Import controls have been advanced as an 'alternative economic strategy' supported by many British trade unionists. These controls would involve much greater government supervision of the economy and can only be supported while there is 'unfair trade' existing in world markets. Such unfair trade is exemplified by the report that GATT reckoned that trade restrictions outside its control affect £60 billion worth of goods (Sunday Times Business News, Graham Serjeant, 29 September 1982).