Claim Your Offer Today

Celebrate this festive season with stress-free economics homework! Get 15% off on all our economics homework help services at EconomicsHomeworkHelper.com. Simply use the code EHHRXMAS15 at checkout and enjoy expert economics homework Help while saving money. Hurry—this holiday offer is for a limited time only!

We Accept

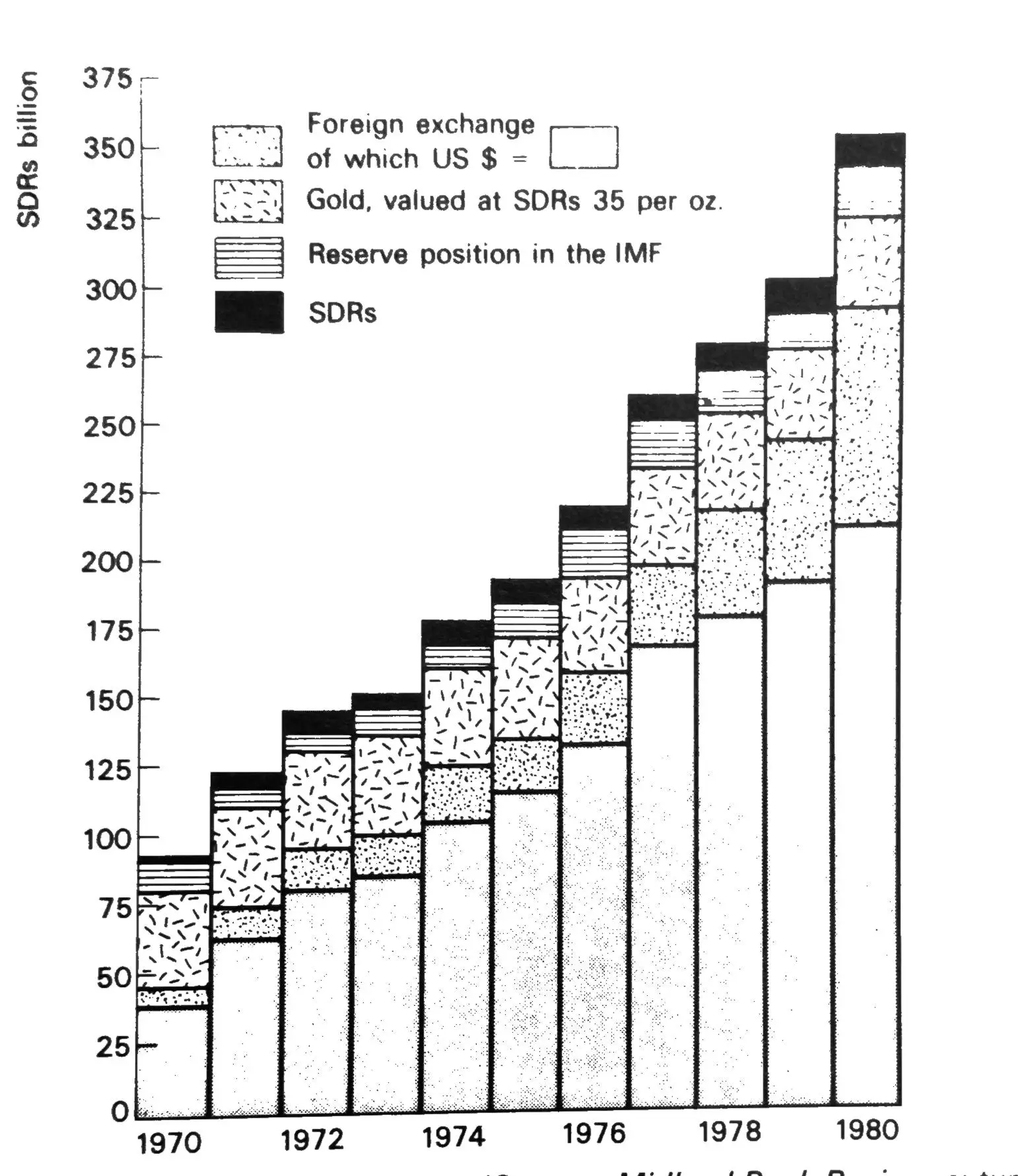

'Liquidity', in an economic context, refers to the means of payment for goods (see Fig. 9.6). Cash is the most liquid of all assets because it is generally accepted as a form of purchasing power; other means of payment have varying degrees of liquidity. International liquidity is more complicated than domestic liquidity because there are so many different currencies. International trade is sometimes described as triangular, but in the more precise language, it is multi-lateral. Bilateral trade (a direct swap agreement) still occasionally takes place, but it has all the disadvantages inherent in a barter economy. Let us try to understand this using an example, if there still remains some confusion availing economics homework help might be useful. After the Second World War, the USSR traded wheat and tinned crab for UK tractors and trawlers, but this type of trade must be limited to a few commodities, and it is difficult to decide how much wheat should be exchanged for how many tractors, without any currency transactions.

Over a given period (say, a year), the UK might have a surplus of Deutschmarks, West Germany might gain a surplus of dollars, and the USA might obtain a surplus of pounds sterling. So long as the currencies involved are allowed to be freely exchanged, i.e., there is free convertibility, a country may make payments to a second country by arranging for a debt owed to be transferred to a third country. So long as the second country can convert into its currency the currency of the third country, the arrangements will prove satisfactory to all three parties. As West German manufacturers, workers, exporters, etc., wish to have Deutschmarks to use within their own country, there is an advantageous opportunity for foreign currency exchange, and the main point at issue is how the rates of exchange should be determined. It would appear, a priori, that exchange rates should be governed by the Purchasing Power Parity theory, as defined by Professor Cassel. According to this theory, the rate of exchange between two currencies depends on the relative price levels in the two countries concerned. In simple terms, if a bottle of wine is priced at $4.60 in the USA, a similar bottle of wine should be priced at about £2 in the UK, if the exchange rate were £1 = $2.30. This is an oversimplification, but it enables us to comprehend the basic principles underlying foreign currency transactions under a system of free exchange rates.

Figure 9.6 The growth of world reserves from 1970 to 1980. (Source: Midland Bank Review, autumn/winter 1981.)

The Gold Standard

According to Euclid, if two things are equal to another thing, they must be equal to each other. Thus if pounds sterling and dollars are related to the price of gold, pounds sterling and dollars are themselves related. The system of tying different countries' currencies to gold worked comparatively well until 1914 when a shortage of gold compelled most countries to abandon the Gold Specie Standard. A modified system, known as the Gold Bullion Standard (using large gold bars of bullion), was introduced in 1925 but disintegrated in 1931 mainly because of the maldistribution of the world's gold resources and because certain countries failed to obey the golden rules of the Gold Standard. While the rules were being obeyed, the Gold Standard acted as a self-correcting method of adjusting surpluses and deficits in the balance of payments. The rules of the Gold Standard, in simplified form, were as follows:

- If gold came into a country, that country should increase its money supply; this would cause some degree of inflation, raise the price of the country's exports, and tend automatically to correct a balance of payments surplus.

- If a country were losing gold, it should deflate its internal currency: cheaper exports sell more easily and the balance of payments deficit would tend to be eliminated. The USA and France, ignoring the 'golden' rules, hoarded gold without allowing it to adjust correctly the cash basis of their money supply, and in the end the Gold Standard collapsed-probably forever. Gold now accounts for only about 20 percent of the total international reserves, and its rate of growth in recent years has been the slowest of any of the reserve components.

Free Exchange Rates

From 1919 to 1925, the rates of exchange between most currencies were allowed to fluctuate and find their market level following the conditions of supply and demand. If at one particular time there were $50 000 and £10000 available for exchange, the prevailing rate would be $5 to the El providing there was no hedging or 'holding back. If the rates differed in the various foreign exchange markets, speculators would intervene with the result that the same equilibrium rate of exchange would result in all markets, in the long run.

There has been a return, in recent years, to more flexible exchange rates; Canada allowed her dollar 'to float in 1970; West Germany floated the Deutschmark, Holland the guilder, and Japan the yen in 1971, and the UK floated the pound in 1972. A floating exchange rate is a compromise between free exchange rates and rigidly fixed exchange rates. The pound was allowed to find its level between wider margins, and during 1972 the rate varied between $2.38 and $2.60 to the pound.

In October 1979, the last UK exchange controls were removed, thus ending 40 years of UK exchange control. In 1980 (largely owing to the rising price of oil and high UK interest rates). The sterling was relatively strong among other currencies and reached a peak of $2.45 to the pound, only to fall to

below $1.76 in August 1981. This was largely brought about by a sharp rise in US interest rates combined with a fall in the UK rates, which resulted in an inevitable capital outflow. There has also been a build-up by UK residents of bank deposits in currencies other than sterling Allowing currencies to float enables rates to be determined by up-to-date market conditions, but there are disadvantages. Fluctuating rates deter exporters and importers, whereas stable rates give them more confidence in their trading activities. When the UK experimented with a floating rate for the pound, just after the Second World War we suffered a serious depletion in the gold and foreign currency reserves within a few weeks. Between the two world wars, some countries practiced a system of discriminatory multiple exchange rates; low rates of exchange would be offered for goods that the country found easy to sell abroad but a higher rate would be given in an attempt to sell less attractive exports. Because of the adverse effects on world trade, Article IV of the IMF declares the Fund's objections to floating rates.

Exchange rates and the IMF

The main purposes of the IMF are:

- To promote exchange stability and discourage multiple exchange rates. (Countries are more likely to engage in trade if they know where they stand and if there is no discrimination against certain countries or in favour of others.)

- To establish a code of good monetary conduct among trading countries.

- To encourage countries to cooperate on international monetary problems.

- To maintain orderly foreign exchange arrangements.

- To avoid competitive exchange depreciation.

- To discourage a country from the devaluation of its currency without previous consultation.

- To provide short-term credit for countries in temporary balance of payments difficulties. (The UK has been the greatest user of the Fund, especially in this respect).

The IMF encourages multilateral trading in an attempt to provide the peoples of the world with a greater variety of economic goods; an increase in real incomes throughout the world has been achieved, especially as a high level of employment is more likely to be maintained if countries are engaged in supplying other countries with goods. Each member of the IMF has to provide a quota. made up of its currency and gold; this quota is determined by the Fund and adjusted every five years.

The IMF has collaborated with member governments in an attempt to establish a stable pattern of exchange rates fixed in ratio to gold and the US dollar. It has faced criticism because the poor countries resent the highly industrialized countries controlling IMF policies.

Exchange control

The Exchange Control Act of 1947 formalized a system by which the UK strictly controlled the exchange rate between the pound sterling and foreign currencies (see Table 9.5). Until June 1972, exchange control, between rather narrow limits, ensured stable exchange rates. During this period. two devaluations of the pound were forced upon UK Government, struggling with a currency that became overvalued. Thus in 1949 and 1967, devaluing actions took place mainly to stimulate the UK export trade. All UK exchange controls have now been removed. However, the EEC requires members to be able to act on capital flows to prevent serious disturbances in the money markets.

Even before the Second World War, the UK practiced some measures of exchange control. After she left the Gold Standard in 1931, the sterling was left free to fluctuate, but since 1932 the Exchange Equalization Account has been used by the Bank of England for intervention in the foreign exchange markets. A fund of sterling was set up in Treasury Bills and a comparatively large amount of foreign currency was purchased. These resources were used to counteract serious fluctuations in the exchange value of sterling. The Exchange Equalization Account has been particularly useful in mitigating the adverse effects of 'hot money, which financial speculators move from one financial center to another in the hope of earning quick profits. The Bank of England has moved frequently into the foreign exchange market to stabilize the price of sterling. The Bank buys sterling if foreigners are selling excessive amounts. It sells sterling for other currencies if foreigners purchase untoward amounts of sterling.

As gold is no longer the basis of our domestic currency, the bulk of the UK's gold and foreign exchange reserves are held in the Exchange Equalization Account.

While the countries of the world continue to use separate currency units, trading nations must have the opportunity to purchase other countries' currencies at comparatively stable rates. All these complex exchange transactions would be obviated if national loyalties were abandoned and a world currency established. This would necessitate at least a limited form of world government and this seems an unlikely event while countries are afraid of infringement of national sovereignties.

Table 9.5 Exchange rates 1947 to 1982

| Year | Rate of Exchange |

|---|---|

| 1947 | $4.03 = £1 |

| 1949 | $2.80 = £1 |

| 1967 | $2.40 = £1 |

| 1972 | $ 2.60 = £1 |

| 1983 (March) | $1.50 = 1 (floating £) |

European Monetary System(EMS)

The EMS came into force on 13 March 1979 to create a zone of monetary stability in Europe, with the later intention of consolidating the system by establishing a European Monetary Fund. The UK did not become a member of the EMS when the system was set up, but Mr. Gordon Richardson (the Governor of the Bank of England) has stated that he hoped it would be possible for the UK to participate fully at the proper time". The essential components of the EMS are:

- A European currency unit (ECU),

- An exchange rate and intervention mechanism.

- A credit mechanism.

- Measures designed to strengthen the less prosperous states in the EMS.

Each of the participating countries has an ECU-related central rate, and these rates are used to establish a grid of bilateral exchange rates. Under EMS, fluctuation margins of +2.25 percent (i.e., 4.5 percent overall) from the central rate have been established for seven EEC currencies and of +6 percent for the lira. The system has worked comparatively well and fluctuations within the system have been lower than they were before the EMS was established.

Special drawing rights

Most world trade is financed using dollars, pounds, or gold, but for many years there has been a severe shortage of world liquidity: world trade has been steadily increasing more than the means of financing it. At the Bretton Woods Conference of 1944, Lord Keynes put forward a British plan for an international institution with the power to grant overdrafts to member nations in the form of a new international currency to be called 'Bancor'. The Americans opposed Keynes' scheme and the result was the IMF quota system. Although the original IMF scheme has been useful in stabilizing exchange rates, the amount of liquidity has remained adequate. Paradoxically. Keynes' ideas were in many respects accepted with the creation of special drawing rights (SDRs) as a new reserve instrument of the IMF on 1 January 1970.

The value of SDRs is fixed about a standard basket of 18 currency values. The launching of the scheme was a revolutionary step in so far as it involved a move towards the deliberate and rational control of liquidity. The intention was that SDRS should be acceptable to central banks as gold: hence the name 'paper gold. The scheme was launched on a modest scale, to enable confidence in the new asset to be built up gradually. The SDRs are international assets that can be used between central banks in cases of balance of payments difficulties. They can be used both direct, between participants in the scheme, and through the IMF, utilizing the designation procedure. Under this procedure, the IMF designates a participant with a strong balance of payments and a reserve position to receive SDRs. The country that is using its SDRs in this way thus gets foreign currency instead with which it can meet its normal obligations. The SDRs can also be used by participants to repurchase their currency held by the IMF and in payment of charges, previously paid in gold.

However, the Articles provide that SDRs are to be used only to finance the balance of payments deficits. and not to change the composition of a country's reserves. A participant's use of SDRs is not conditional in any way on its use of the IMF's other resources.

The SDRs can be used only to obtain currency and cannot be exchanged for gold. They can be held only by participants and cannot be used in market transactions with private parties.

Conclusion

In International Economic Relations (IEA 2nd and. 1970), K. B. Drake has divided the remedies for the shortage of world liquidity into three schools of thought:

- Gold radicals contend that the world should return to the system of using gold as the only medium of exchange for international trade.

- Banking radicals favor the creation of a new international currency.

- Modifiers believe that the liquidity shortage problem can be solved by increasing the scope and flexibility of present foreign exchange arrangements.

Professor Grubel, in The International Monetary System (Penguin), has discussed the main difficulties of world monetary reform. Three main difficulties are:

- Central bankers' reluctance to change the status quo.

- Reforms would bring benefits to some countries and disadvantages to others in different relative magnitudes.

- Agreement in principle (that more flexibility and larger reserves are essential) breaks down over questions of detail.