Avail Your Discount Now

Discover an amazing deal at www.economicshomeworkhelper.com! Enjoy a generous 10% discount on all economics homework, providing top-quality assistance at an unbeatable price. Our team of experts is here to support you, making your academic journey more manageable and cost-effective. Don't miss this chance to improve your skills while saving money on your studies. Grab this opportunity now and secure exceptional help for your economics homework.

We Accept

- What is Cross Price Elasticity of Demand?

- Understanding the Significance of the Sign

- 1. Positive Cross Price Elasticity (Substitutes)

- 2. Negative Cross Price Elasticity (Complements)

- 3. Zero or Near Zero Cross Price Elasticity (Unrelated Goods)

- Practical Implications for Students

- 1. Analyzing Market Dynamics

- 2. Solving Homework Problems

- 3. Real-World Applications

- Case Studies and Examples

- 1. Technology Sector

- 2. Food Industry

- 3. Healthcare

- Conclusion

In the study of economics, cross price elasticity of demand is a pivotal concept that reveals the interconnectedness of different goods in the market. Understanding cross price elasticity is essential for students tackling assignments and exams because it provides insights into how changes in the price of one good can impact the demand for another. This concept helps explain whether two goods are substitutes, complements, or unrelated, which is crucial for analyzing market dynamics and consumer behavior.

Cross price elasticity measures the percentage change in the quantity demanded of one good in response to a percentage change in the price of another good. Its sign—whether positive or negative—indicates the nature of the relationship between these goods. A positive cross price elasticity suggests that the goods are substitutes, meaning an increase in the price of one good will lead to an increase in demand for the other. Conversely, a negative cross price elasticity signifies that the goods are complements, where a price rise in one good leads to a decrease in demand for the other.

For students, mastering this concept is crucial for solving a range of economics problems and assignments. It helps in understanding how businesses might react to price changes in related products and how these reactions can affect overall market equilibrium. Whether analyzing real-world scenarios or theoretical models, a solid grasp of cross price elasticity will enhance students' ability to interpret economic data, make predictions, and apply economic principles effectively in their economics homework and exams.

What is Cross Price Elasticity of Demand?

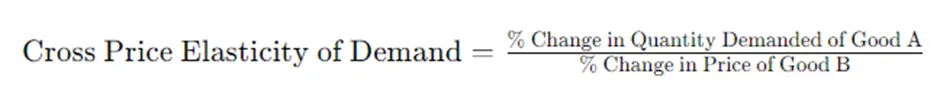

Cross price elasticity of demand is a measure that captures how the quantity demanded of one good changes in response to a change in the price of another good. It is calculated using the formula:

This formula helps quantify the relationship between two goods—whether they are substitutes, complements, or unrelated. By analyzing cross price elasticity, students can determine how sensitive the demand for one product is to price changes in another product, providing insights into their economic interdependence.

Understanding the Significance of the Sign

The sign of the cross price elasticity of demand is crucial as it indicates the nature of the relationship between two goods. Here’s a detailed look at what different signs signify:

1. Positive Cross Price Elasticity (Substitutes)

A positive cross price elasticity indicates that the two goods are substitutes. When the price of Good B rises, the quantity demanded for Good A increases, and vice versa. This happens because consumers switch from the more expensive good to the less expensive substitute.

Example: Consider coffee and tea. If the price of coffee increases significantly, consumers may start buying more tea instead, assuming tea is a good substitute. This positive elasticity shows that the two goods compete with each other in the market. Understanding this relationship helps businesses set competitive prices and anticipate changes in demand based on pricing strategies of competitors.

Implications for Business: Businesses can use this information to forecast how price changes in related products will affect their own sales. For instance, if a company sells a product that competes with another product in the market, knowing the cross price elasticity helps in making pricing decisions and formulating marketing strategies. If a competitor raises their prices, a company might adjust its own pricing or increase promotions to capture a larger market share.

2. Negative Cross Price Elasticity (Complements)

A negative cross price elasticity signifies that the goods are complements. This means that when the price of Good B rises, the demand for Good A falls. Complementary goods are typically consumed together, so an increase in the price of one leads to a decrease in the demand for the other.

Example: Imagine printers and ink cartridges. If the price of printers goes up, fewer consumers might purchase printers, leading to a decrease in the demand for ink cartridges. Understanding this negative relationship is vital for businesses that sell complementary products, as it helps in predicting how changes in the price of one product can affect the demand for another.

Implications for Business: For firms selling complementary goods, this knowledge can guide decisions on pricing and promotions. For example, a company that sells both coffee machines and coffee pods might adjust prices or offer discounts on coffee machines to boost sales of coffee pods. Effective management of complementary product relationships can enhance overall sales and profitability.

3. Zero or Near Zero Cross Price Elasticity (Unrelated Goods)

A cross-price elasticity of zero or near zero indicates that the goods are unrelated. Changes in the price of one good have minimal or no effect on the demand for the other. These goods do not influence each other’s market behavior.

Example: The price of furniture is unlikely to affect the demand for toothpaste. Since these goods serve different needs and are not substitutes or complements, their market dynamics remain largely independent of each other. Recognizing when goods are unrelated helps avoid unnecessary adjustments in pricing or marketing strategies based on the price movements of unrelated products.

Implications for Business:Understanding that two products are unrelated can prevent businesses from overreacting to changes in the prices of products that do not impact their sales. This knowledge helps in focusing efforts and resources on products and strategies that have a meaningful impact on their market.

Practical Implications for Students

1. Analyzing Market Dynamics

Understanding cross price elasticity helps students analyze various market dynamics. For example, when studying how price changes affect consumer behavior, knowing whether goods are substitutes or complements provides deeper insights into market trends. This analysis is essential for answering questions about market strategies and consumer choices.

2. Solving Homework Problems

Many economics homework problems involve interpreting elasticity data. For instance, if given the cross price elasticity for two goods, students must determine if they are substitutes, complements, or unrelated. This information is crucial for solving problems accurately and understanding the implications of elasticity in different scenarios.

3. Real-World Applications

Grasping cross price elasticity is not only important for academic purposes but also for real-world applications. Businesses use this concept to make pricing decisions, plan marketing strategies, and predict consumer responses to price changes. For example, a company entering a new market can use cross price elasticity to forecast how changes in competitors' prices will impact their own sales. Students who understand these applications are better prepared for careers in economics, business, and policy analysis.

Case Studies and Examples

To further illustrate the importance of cross price elasticity, let’s consider a few real-world examples and case studies:

1. Technology Sector

In the technology sector, the relationship between smartphones and tablets can be analyzed through cross price elasticity. If the price of high-end smartphones decreases, it might lead to a decrease in demand for tablets as consumers may find that smartphones fulfill their needs for both communication and entertainment. Companies in the tech industry need to understand these relationships to optimize their product lines and pricing strategies.

2. Food Industry

In the food industry, the relationship between fast food and healthier options like salads can be explored. A rise in the price of fast food might lead to an increase in demand for salads, reflecting a substitution effect. Understanding these dynamics helps food chains and restaurants adjust their menu offerings and pricing strategies to cater to changing consumer preferences.

3. Healthcare

In healthcare, the cross price elasticity between prescription medications and over-the-counter alternatives can provide insights into consumer behavior. For example, if the price of prescription medications rises, patients might turn to over-the-counter alternatives, affecting the demand for both types of products. Healthcare providers and pharmaceutical companies use this information to strategize pricing and product availability.

Conclusion

Cross price elasticity of demand is a fundamental concept in economics that sheds light on how the demand for one product is influenced by the price changes of another. By understanding the significance of positive, negative, and zero cross price elasticity, students can gain valuable insights into market behavior and make informed decisions. This knowledge is crucial for solving assignments and understanding real-world economic relationships.