Avail Your Discount Now

Discover an amazing deal at www.economicshomeworkhelper.com! Enjoy a generous 10% discount on all economics homework, providing top-quality assistance at an unbeatable price. Our team of experts is here to support you, making your academic journey more manageable and cost-effective. Don't miss this chance to improve your skills while saving money on your studies. Grab this opportunity now and secure exceptional help for your economics homework.

We Accept

- The Fundamentals of Present Value

- Present Value Explained

- The Time Value of Money (TVM)

- How Rising Interest Rates Affect Present Value

- The Role of Interest Rates

- Mathematical Illustration

- Factors Influencing the Impact of Rising Interest Rates

- Duration of Payments

- Compounding Frequency

- Economic Conditions

- Practical Applications and Examples

- Investment Decisions

- Loan and Mortgage Analysis

- Valuation of Financial Assets

- Conclusion

Understanding the impact of rising interest rates on the present value of future payments is a key concept in economics that frequently appears in academic assignments and financial analysis. This relationship is rooted in the fundamental principle of the time value of money, which asserts that a dollar today holds more value than a dollar in the future due to its potential earning capacity.

As interest rates rise, the discount rate applied to future payments also increases. This is crucial for students to grasp, as it directly affects how much a future amount of money is worth in today's terms. Higher interest rates mean that future payments are discounted more heavily, leading to a lower present value. This inverse relationship between interest rates and present value is essential for solving problems related to investment valuation, financial planning, and loan analysis.

For students working on economics homework, mastering this concept helps in various ways. It enables you to accurately calculate the present value of future cash flows, assess the impact of changing interest rates on financial decisions, and understand the underlying economic principles that drive these calculations. Whether you’re analyzing investment opportunities, evaluating loan costs, or studying financial markets, a clear understanding of how interest rates affect present value will enhance your ability to solve complex problems and make informed decisions.

In essence, the effect of rising interest rates on present value is not just an abstract theory but a practical tool for financial analysis and decision-making. By familiarizing yourself with this concept, you can approach your monetary economics homeworkwith confidence and develop a deeper understanding of financial dynamics.

The Fundamentals of Present Value

Present Value Explained

Present value (PV) refers to the current worth of a future sum of money or series of payments, discounted at a specific rate. This concept helps in understanding how much a future amount of money is worth in today’s terms. Essentially, it answers the question: “What is the value today of a payment or series of payments received in the future?”

The formula for calculating the present value of a single future payment is:

.webp)

where:

- PV = Present Value

- FV = Future Value

- r = Discount Rate (interest rate)

- n = Number of periods

The Time Value of Money (TVM)

The principle of the time value of money underpins the concept of present value. TVM suggests that a dollar today is worth more than a dollar in the future because of its potential earning capacity. Money available today can be invested to earn interest, making it more valuable than the same amount in the future. This principle is crucial in understanding why future payments are discounted when calculating their present value.

How Rising Interest Rates Affect Present Value

The Role of Interest Rates

Interest rates act as the discount rate in the present value formula. When interest rates rise, the discount rate increases, affecting the present value of future payments. Here’s a closer look at the mechanism:

- Increased Discount Rates: Rising interest rates mean that the discount rate applied to future payments is higher. The present value is calculated by dividing the future payment by a larger number due to the higher discount rate. For example, if you are set to receive $1,000 in 10 years and the interest rate increases, the present value of that future $1,000 decreases because you are discounting it more heavily.

- Opportunity Cost: Higher interest rates reflect a higher opportunity cost of capital. When interest rates rise, alternative investment opportunities become more attractive, potentially yielding higher returns. To account for this, future payments must be discounted more to reflect the opportunity cost of not investing at the new, higher rate. This adjustment reduces the present value of future payments.

Mathematical Illustration

To better understand how interest rates impact present value, consider the following example:

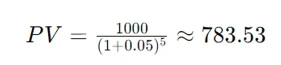

- Scenario 1: You are to receive $1,000 in 5 years. If the interest rate is 5%, the present value is calculated as follows:

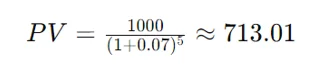

- Scenario 2: With an interest rate of 7%, the present value changes to:

As illustrated, the present value decreases from approximately $783.53 to $713.01 when the interest rate rises from 5% to 7%.

Factors Influencing the Impact of Rising Interest Rates

Duration of Payments

The length of time until the future payment is received affects the sensitivity of present value to changes in interest rates. The longer the time period, the more significant the impact of rising interest rates. For example, a 1% increase in interest rates will have a more pronounced effect on the present value of a payment due in 20 years compared to one due in just 2 years. This is because the effect of compounding over a longer period amplifies the impact of the higher discount rate.

Compounding Frequency

Interest rates can be compounded at different frequencies—annually, semi-annually, quarterly, or monthly. The frequency of compounding affects the effective annual rate and thus the present value. More frequent compounding results in a higher effective rate and a lower present value. For instance, if interest is compounded monthly rather than annually, the present value of future payments will be lower due to the more frequent application of interest.

Economic Conditions

Broader economic conditions also play a role in how rising interest rates affect present value. Inflation, monetary policy, and overall economic growth influence interest rates and, consequently, the present value of future payments. In times of high inflation, central banks may raise interest rates to control inflation, which in turn impacts the present value calculations.

Practical Applications and Examples

Investment Decisions

Understanding how rising interest rates affect present value is crucial for making informed investment decisions. Investors use present value calculations to assess whether the returns on future cash flows justify the current investment. If interest rates are rising, the present value of future cash flows decreases, which might make some investments less attractive compared to others that offer higher returns.

Loan and Mortgage Analysis

For borrowers, rising interest rates increase the cost of loans and mortgages. The present value of future payments on these loans becomes higher in today’s terms, affecting decisions on borrowing and repayment. For example, if you’re evaluating the cost of a mortgage with rising interest rates, the present value of future mortgage payments will be higher, influencing your decision on whether to lock in a fixed rate or opt for an adjustable rate.

Valuation of Financial Assets

In corporate finance, the valuation of financial assets such as bonds and stocks relies on present value calculations. Rising interest rates can lead to lower present values for bonds and stocks as the discount rate applied to future cash flows increases. This impacts the market value of these assets and influences investment strategies and financial planning.

Conclusion

Rising interest rates have a significant impact on the present value of future payments. As interest rates increase, the discount rate used in the present value calculation rises, resulting in a lower present value. This relationship is crucial for students working on economics assignments and for anyone involved in financial decision-making.

By understanding how rising interest rates affect present value, you can confidently approach homework problems related to this concept and make informed financial decisions. If you need further assistance with your economics homeworks or have questions about related topics, EconomicsHomeworkhelper.com is here to support your academic journey.